- +254 (20) 2710051/71/73/75/81 or (0)736 712 864

- info@src.go.ke

- Rewarding Productivity

First Quarter Wage Bill Bulletin (July-September 2022)

January 25, 2023 | 5:13 pm

Full report link:

a) Introduction

This Wage Bill Bulletin covers the first quarter of the Financial Year (FY) 2022/2023, that is, July–September 2022. The quarter was characterised by high intensity general election campaigns, which slowed down in mid-September 2022, after the swearing in of the new President of Kenya.

b) SRC First Quarter Advice

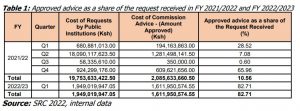

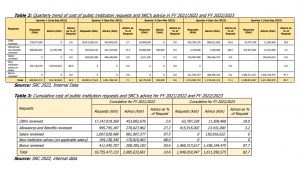

During the period under review, SRC received 23 requests that had a cost implication amounting to Ksh 1,949,019,947. The requests received were as follows: a) Salary reviews (2); b) Collective Bargaining Negotiations (5); c) Allowances and Benefits (14); and d) Performance bonus (2).

Out of this, SRC approved requests worth Ksh 1,611,950,575 (82.71% of the total requests). Through this intervention, SRC saved taxpayers Ksh 337,069,373.

The cost implication of the approved requests by SRC during Q1 of FY 2021/2022 was 28.52 per cent, while in the current financial year, the cost implication stands at 82.71 per cent as at the end of the first quarter. The cost implication in absolute terms is higher in FY 2022/2023 than in FY2021/22.

Table 1 below shows the approved requests as a share of the requests placed by public institutions during the FY 2021/22 and FY 2022/23.

Tables 2 and 3 below show the quarterly data on the cost implications for FY 2021/2022, and the breakdown of the cumulative cost implications of the requests received from public institutions.

The tables also show SRC’s advice categorised into CBAs; Allowances and Benefits; Salary reviews; new institution advice (on applicable salary); and Bonus reviews.

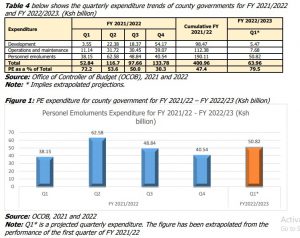

c) Personnel emoluments for county governments

The Public Finance Management (PFM) Act, 2012, and the attendant PFM (Regulations), 2015, set the threshold of not more than 35 per cent of wage bill to total revenue ratio.

The county government wage bill for the first quarter of FY 2022/2023 is projected to have increased to Ksh 50.82 billion from Ksh 38.15 billion in the first quarter of FY 2021/22. The projection is based on the same percentage increase in the previous financial year.

During the first quarter, the personal emoluments (PE), as a share of the total revenue ratio, is projected to be 79.5 per cent, which is above the recommended 35 per cent threshold.

As such, county governments are advised to institute appropriate measures to ensure adherence to the PFM (County Government) Regulations, 2015, threshold on PE to revenue ratio of not more than 35 per cent, of the total revenue spent on PE.

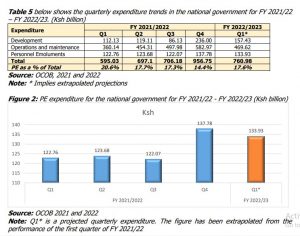

d) PE for the national government

During the first quarter, the expenditure on PE in the national government is projected to be Ksh 133.96 billion, representing a 9.1 per cent increase compared to Ksh 122.76 billion in the first quarter of FY 2022/23.

Notes:

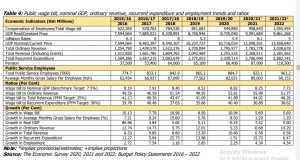

a) The total wage bill, GDP nominal, total revenue and total public service employees for FY 2021/22 were projected using the same growth rate as the previous year.

b) The real GDP value for FY 2021/22 has been projected using a growth rate of 5 per cent as projected in the Economic Survey 2022.

c) The inflation rate, total ordinary revenue and total recurrent expenditure for FY 2021/22, are as projected in the Economic Survey 202

Observations

1) The wage bill to nominal GDP ratio was 7.91 per cent in FY 2016/2017, rising to 8.82 per cent in FY 2019/2020. The ratio decreased to 8.25 per cent in FY 2020/2021 and is projected to reduce further to 7.73 per cent in FY 2021/2022. This ratio is projected to decrease towards 7.5 per cent in line with the average for developing countries, and approximately 7 per cent, which is the internationally desirable level.

2) The wage bill to ordinary revenue ratio has been fluctuating between 46 per cent in FY 2016/2017 and 56 per cent in 2020/2021, and is projected to reduce slightly to 51.77 per cent in FY 2021/2022.

3) The wage bill to total revenue ratio has been oscillating between 40 per cent in 2016/2017 and 44 per cent in 2020/2021, and is projected to increase to 46.26 per cent in FY 2021/2022. This implies that the ratio is projected to remain above 40 per cent in FY 2021/2022, significantly above 35 per cent, which is the recommended ratio as PFM Act, 2012, and PFM Regulations, 2015.

4) The wage bill to recurrent expenditure ratio recorded the lowest and highest ratios in FY 2018/2019 (35.86%) and FY 2016/2017 (40.48%), respectively. The ratio is projected to reduce slightly from 36.89 per cent in FY 2020/2021 to 36.62 per cent in FY 2021/2022.

5) The number of public service employees rose from 774,700 in 2015/2016 to 923,100 in FY 2020/2021. On average, the public service labour force grew by 4.34 per cent as at FY 2020/2021, and is projected to grow by the same rate to 963,200 employees in FY 2021/2022.

e) Economic indicators affecting wage bill sustainability

e.1) Consumer Price Index and inflation rate

The Consumer Price Index (CPI) is a measure that examines the weighted average of prices of a basket of consumer goods and services, such as transportation, food, and medical care.

It is calculated by taking price changes for each item in the predetermined basket of goods and averaging them. Changes in the CPI is used to assess price changes associated with the cost of living.

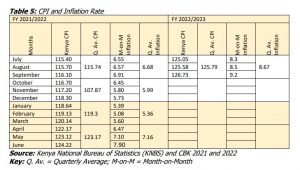

The CPI increased from 125.05 in July 2022 to 125.58 in August 2022, and to 126.73 in September 2022. In comparison with the same period in the previous financial quarter, the CPI was 115.40 in July 2021, 115.70 in August 2021, and 116.10 in September 2021, respectively.

e.2) Inflation rate

Inflation is a persistent increase in the general price of goods in an economy over a given period of time. During the first quarter, inflation was above the target range of 5 per cent, plus or minus 2.5 per cent set by the Central Bank of Kenya (CBK).

Inflation has been increasing from 8.32 per cent in July 2022, to 8.53 per cent in August 2022, to 9.2 per cent in September 2022. This is occasioned by the disruption of the global supply chains caused by the Ukraine-Russia war and the anxiety among economic actors in the country over the general elections.

The average inflation rate during the review period was 8.67, compared to an average of 6.68 per cent for the first quarter of FY 2021/2022. Inflation was fairly stable during the first quarter of FY 2021/22, compared to FY 2022/23, where inflation has been increasing at a faster rate.

f) Revenue performance

The National Treasury projects that the total revenue collection for FY 2022/2023 will amount to Ksh 2,480 billion, equivalent to 17. 5 per cent of GDP. Of this, ordinary revenue is estimated at Ksh 2,142 billion, equivalent to 15.3 per cent of GDP.

This revenue projection is approximately Ksh 449 million higher than the total revenue collection of Ksh 2,031 billion in FY 2021/2022.

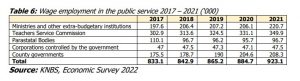

g) Public service employees

According to KNBS (2022), Kenya’s total workforce stands at 12 million, with 10 million being in the informal sector. Only two million of the workforce constitute the formal sector, which comprises government civil service, staff of parastatals and the private sector employees.

The share of private sector employment was 68.3 per cent in 2021, which was slightly higher than the previous year, which stood at 67.8 per cent.

Employment in the public service increased by 4.3 per cent to 923,100 employees in 2021, compared to 2.3 per cent recorded in 2020. The increase was mainly attributed to recruitment in the civil service for essential services. This shows that the public service will continue to attract skills from the labour market.

h) Conclusion

During the first quarter, the following were observed:

1) SRC continued to receive and review various requests on salaries and benefits from public service institutions.

2) Revenue is projected to decline on account of economic slowdown due to the general election-related activities, which historically slows down the economic performance.

3) The cost of living is likely to rise as a result of increase in fuel prices and the removal of fuel subsidy, hence, a likely demand for pay increase.

4) The wage bill for the national and county governments is projected to increase as a result of the creation of new offices, such as the Office of the Prime Cabinet Secretary, among others, in addition to existing ones.

Select Latest News and Events to view

The Third National Wage Bill Conference (NWBC)

Question-and-answer session on revenue and wage bill management – Day 2

Third National Wage Bill Conference Day 2

The 3rd National Wage Bill Conference

CAPACITY BUILDING ON PRODUCTIVITY MEASUREMENT

GETTING TECH SAVVY: SRC ROLLS OUT AUTOMATED WAGE BILL MONITORING INFORMATION SYSTEM

Executive and CCIOs adopt joint resolution on closer collaboration

Extending partnerships into the civil society world

Going Live on Kitwek FM

Outlining SRC’s mandate on Mulembe FM

Stagnation in the public service

All in a day’s work: Part-time versus full-time

Insight into the remuneration of health workers in the public service

Launch of Framework for Recognising Productivity and Performance in the Public Service

Hon. Justin Bedan Njoka Muturi, EGH

Skip to content