- +254 (20) 2710051/71/73/75/81 or (0)736 712 864

- info@src.go.ke

- Rewarding Productivity

- Background Information

Prior to establishment of Salaries and Remuneration Commission (SRC), remuneration and benefits payable to public officers were set through ad hoc Committees. Owing to the limited mandate of the foregoing Commissions and Committees, they only addressed remuneration and benefits in selected sectors and subsectors of the Public Service. The absence of a holistic approach led to substantial differences in salaries, allowances, other benefits and grading resulting in discontentment, low morale and inefficiencies in the Public Service.

This situation was not helpful to an economy eyeing fast growth, supported by a vibrant Public Service. Moreover, the country was saddled by a ballooning public wage bill that required concerted effort to: first, harmonise the salaries of all public servants; and second, lay strong foundation to manage a bloated wage bill, thus free funds for development projects.

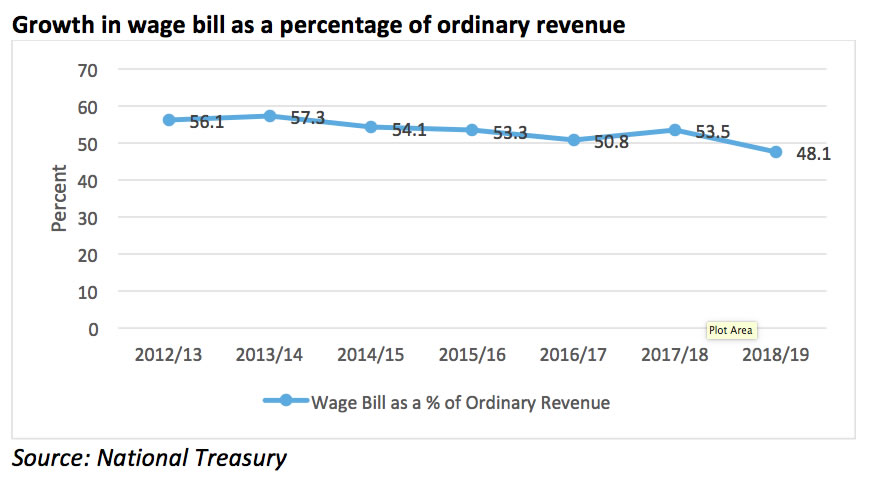

The public sector wage bill has shown a positive trend from 57.33% of ordinary revenue in 2013/2014 to 48.1% in 2018/2019 as a result of previous initiatives by stakeholders. However, concerted effort by all arms of government is required to achieve a wage bill of 35% of ordinary revenue as per the PFM regulations (2015) and a wage bill to GDP of 7.5% from the current 8.1% in line with average for developing Countries. A fiscally sustainable wage bill releases additional resources to address the Big 4 agenda and other development goals.

Source: National Treasury

Public sector wage bill comprises of wages and salaries, allowances and benefits awarded to all public sector employees. Key drivers of the public sector wage bill are:

- Demand for high salary increases by employees;

- Weak recognition of performance and productivity framework in wage determination;

- Increase in the number of public servants; and

- Increase in pension liability.

Copyright © 2024. Salaries and Remuneration Commission (SRC). All Right Reserved. | Staff Intranet | Terms of Use | Privacy Policy | Sitemap